Company Update / Banks / IJ / Click here for full PDF version

Author(s): Jovent Muliadi ;Axel Azriel

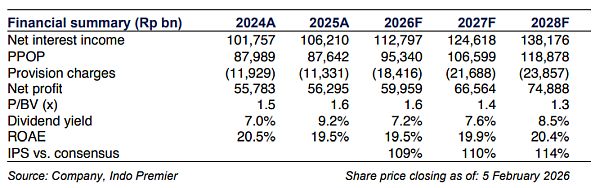

- FY25 net profit of Rp56.3tr (+1% yoy) came in-line with ours but above cons (101/110%). CoC came at 58bp with 60-80bp guidance for FY26F.

- NIM slipped -26bp yoy from lower loan yield though CoF has improved. Deposit rose +24% yoy while loan grew +13% yoy from corporate.

- Asset quality was resilient especially on NPL/LAR. We maintain Buy and keep our TP unchanged despite upgrading our FY26-27F EPS by 2%.

4Q25 results: above consensus but in-line with ours

recorded net profit of Rp56.3tr in FY25 (+1% yoy/+40% qoq in 4Q25); in-line with ours but above consensus FY25F estimates at 101/110% which we have highlighted in our previous note (link). PPOP came flat yoy (+22% qoq) from solid non-II (+9% yoy/+23% qoq - largely due to recovery) and decent NII (+4% yoy). CIR improved to 43.5% vs. 44.6% in 3Q25 and it guides for normalizing CIR at 42-43% in FY26F. Provision eased -5% yoy (-73% qoq) which translates to lower CoC of 58bp (-21bp yoy/-15bp qoq), far behind its guidance of 80-100bp in FY25F. It guides for CoC of 60-80bp in FY26F.

Improving CoF though NIM declined from lower loan yield

Consolidated NIM slipped -26bp yoy to 4.9% in FY25 (flat qoq), in-line with guidance of 4.8-5.0%. It was driven by lower loan yield (-61bp yoy) and declining LDR at 88% vs. 95% in 4Q24 though CoF improved -20bp yoy. Deposit grew +24% yoy with TD surging +58% yoy and came at +13% yoy (CA/SA at +17%/+8% yoy). It guides for lower NIM at 4.6-4.8% in FY26F as it expects continued pressure on loan yield particularly in wholesale.

Robust loan growth driven by corporate and commercial

Loan growth of +13% yoy (+7% qoq) was above its guidance of 8-10%. It was led by corporate (+23% yoy) driven by village cooperative ( KDMP ) loans, followed by commercial (+12% yoy). Micro & payroll grew +4% yoy while consumer remained slow at +1% yoy. It expects FY26F loan growth of 7-9%.

Improving NPL/LAR with lower LAR coverage

NPL improved to 1.1% in 4Q25 (vs. 1.2%/1.1% in 3Q25/4Q24), primarily from lower formation in corporate and commercial segments, along with better LAR at 6.5% (vs. 6.5%/6.8% in 3Q25/4Q24). LAR coverage declined to 40% vs. 45% in 3Q25/4Q24.Recovery/write-off ratio reached 114% in FY25 (vs. 61% in FY24), with write offs at Rp6.4tr in FY25 (-42.3% yoy) vs. Rp11.1tr in FY24 - this is important as lower write-offs suggesting improving asset quality.

remains our top pick amid the strong beat

We maintain our Buy rating on and foresee a 7% EPSgrowth in FY26F and 11-13% in FY27-28F.It currently trades at attractive valuation of 1.5x P/B and 7.9x FY26F P/E (vs. 10Y avg. of 1.6x P/B and 11.4x P/E).Risks are sudden deterioration in asset quality/CoC.

Sumber : IPS