Company Update / Banks / / Click here for full PDF version

Author(s) :Jovent Muliadi, Anthony

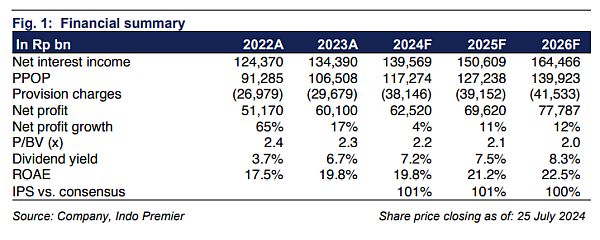

- 1H24 net profit of Rp29.7tr (+1% yoy) was relatively in-line at 48% as decent PPOP (+12% yoy) was offset by higher provision (+34% yoy).

- CoC improved to 3.1% in 2Q24 from 3.8% in 1Q24 and kept its 3% CoC target unchanged. Net downgrades have also improved.

- Management remained cautious on the 2H24 outlook which we view as being more conservative. Maintain Buy and remains as our top pick.

1H24 results: in-line results as robust PPOP was offset by higher CoC

posted 1H24 net profit of Rp29.7tr (+1% yoy/-13% qoq), relatively inline at 48% of our/consensus FY24F estimates. PPOP growth was robust at +12% yoy/-14% qoq, mainly driven by non-II (+21% yoy/+3% qoq) especially recovery (+51% yoy/+30% qoq) at Rp10.1tr in 1H24 vs. FY24F target of Rp22-24tr. Meanwhile, opex growth came at +8% yoy/+16% qoq. Provision rose by 34% yoy but declined -27% qoq and brought 1H24 CoC to 3.5% in 1H24 (3.1% in 2Q24) vs. 2.3/3.8% in 1H23/1Q24, a sequential qoq recovery.

Key positives: qoq CoC/downgrades improvement while additional restructured loan has also been incorporated to CoC guidance

Key positives are: 1) better qoq CoC (3.1% in 2Q24 vs. 3.8% in 1Q24) and net micro downgrades (5.9tr in 2Q24 vs. 7.3tr in 1Q24 - it targets for total Rp9tr in 2H24 indicating 32% improvement vs. 1H); 2) it mentioned that it shall have Rp15-20tr of micro restructuring this year (1H24 at Rp5.7tr, hence another Rp10-15tr in 2H24), however it has incorporated 30-35% default rate of this restructured portfolio into the 3% CoC guidance. 3) We are confident on its corporate expansion as it was driven by quality names i.e. Bulog and private retailer; worth noting that the growth in corporate seems exceptionally strong (+29% yoy/+10% qoq) amid low base effect. 4) Higher non-II from recovery income (Rp5.7tr in 2Q vs. Rp4.4tr in 1Q) is also positive.

Key concerns: miss in CoC target, slower micro growth and lower NIM from change in portfolio mix

We note few concerns, namely: 1) management reiterated that there is a possibility to miss 3% CoC guidance if: a) weaker than expected loan growth (smaller denominator), b) higher default rate to its micro restructured portfolio (currently it uses 30-35% default rate which is suffice in our view). 2) Slower micro growth (+8% yoy/flat qoq) as the focus is on asset quality, but we view this more positively as Kupedes still grew by +16% yoy vs. KUR -1% yoy and lastly 3) lower NIM at 7.6% in 1H24 vs. 7.9/7.8% in 1H23/1Q24 from change in loan mix (higher corporate) and higher CoF (as deposit was driven by TD and high cost CA); it kept its NIM guidance unchanged.

We think the positives outweigh the negatives; maintain BRI as our pick

We understand most will be bearish on the stock following the call but we are more pragmatic and see that there is tangible improvement in asset quality: 1) lower qoq CoC, 2) drop in LAR (12% in 2Q24 vs. 12.7% in 1Q24) and most importantly 3) flat write-off in absolute amount (Rp10.8tr in 2Q24 vs. Rp10.4tr in 1Q24), this also confirmed our thesis that this wasn't a structural event (link). We also have expected that the 2H24 outlook to be more cautious following what happened in 1Q as management will adopt more conservative stance going forward. That being said, we think that after -27% drop from peak and valuation of 11.4x P/E and 2.2x P/B vs. its 5Y average of 16.4x and 2.4x, the risks have mostly been priced-in. We maintain as our pick along with .

Sumber : IPS