Sector Update / Banks / Click here for full PDF version

Author: Jovent Muliadi ; Anthony

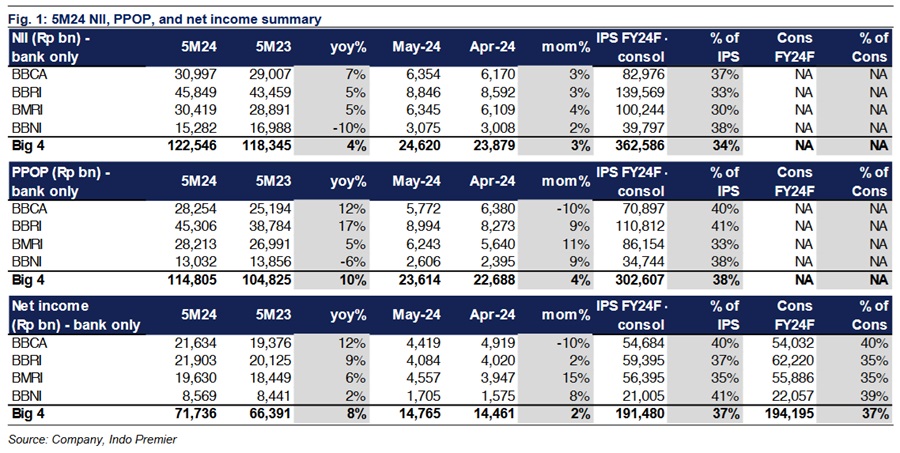

- Aggregate big 4 banks 5M24 profit came ahead at +8% yoy vs. cons' +5% yoy. remained the weakest.

- continued to book the strongest loan and deposits growth on both yoy and mom basis resulted in improvement on its LDR (-300bp mom).

- posted a strong rebound in May24 driven by robust non-II (dividend). We expect its CoC to start normalize in 3Q. Maintain OW.

5M24 bank-only results: overall decent results except for

Big 4 banks bank-only posted an earnings growth of +8% yoy/2% mom to Rp71.7tr in 5M24, ahead with ours/consensus' estimates of +4%/5% yoy. NII/PPOP growth was decent at +4/10% yoy (+3/+4% mom) - as all banks posted positive yoy growth except for at -10/-6% yoy. Provision rose by +17% yoy/+9% mom mainly from . NIM stood at 5.5% in 5M24 (vs. 5.8/5.6% in 5M23/4M24). Overall loan grew by +15% yoy/+1% mom while deposits growth came at +11% yoy/+1% mom.

5M24 results: strongest earnings growth with lowest CoC

bank-only profit of Rp21.6tr in 5M24 (+12% yoy/-10% mom) came in-line. PPOP rose by +12% yoy/-10% mom driven by NII (+7% yoy/+3% mom) and lower opex (-2% yoy/+7% mom). Provision rose by +29% yoy/-36% mom and resulted in CoC of 0.5% (vs. FY24F target of 30-40bp). NIM improved by +15bp yoy to 5.9% in 5M24 due to increase in LDR to 75% vs. 68% in 5M23. Loan grew by +16% yoy (+1% mom) while deposit at +5% yoy (flat mom).

5M24 results: robust non-II; expect CoC to normalize soon

bank-only profit of Rp21.9tr in 5M24 (+9% yoy/+2% mom) was ahead consensus' forecast of +4% yoy as PPOP grew by +17% yoy/+9% mom driven by robust non-II (+41% yoy/+79% mom driven by Rp2.5tr dividend income). Meanwhile, NII was modest at +5% yoy/+3% mom. Provision rose by +31% yoy/+19% mom which resulted in CoC of 3.8% in 5M24, a +60bp yoy increase but flattish mom. We expect 's CoC to peak in 2Q and will start to normalize as soon as 3Q - note that it kept FY24F CoC guidance of <= 3% unchanged. NIM was flattish mom at 7% in 5M24. Loan grew by +11% yoy (+1% mom) while deposit at +16% yoy (flat mom).

5M24 results: strongest loan and deposit growth

bank-only profit of Rp19.6tr in 5M24 (+6% yoy/+15% mom) came above consensus' target of +2% yoy. PPOP up by +5% yoy/+11% mom while NII also rose by +5% yoy/+4% mom. Provision declined by -4% yoy/-2% mom and led to CoC of 0.9% in 5M24 vs. 1.1/1.0% in 5M23/4M24. NIM contracted by -15bp mom to 4.9% in 5M24 amid drop in LDR of c.300bp mom. Loan grew by +20% yoy (+2% mom) while deposit up by +13% yoy (+5% mom).

5M24 results: remains behind amid weak NII/PPOP and this was despite steep jump in LDR

bank-only profit of Rp8.6tr in 5M24 (+2% yoy/+8% mom) was below cons' estimate of +5% yoy. Provision dropped by -20% yoy/+9% mom and brought 5M24 CoC to 1.0% vs. 1.4/1.0% in 5M23/4M24. NIM stood at 3.8% in 5M24 vs. 4.6/3.7% in 5M23/4M24. Loan grew at +13% yoy (+1% mom) and deposits at +7% yoy (-4% mom) with LDR now at 90% (+430/420bp yoy/mom).

Sumber : IPS